Compound interest calculator annual deposit

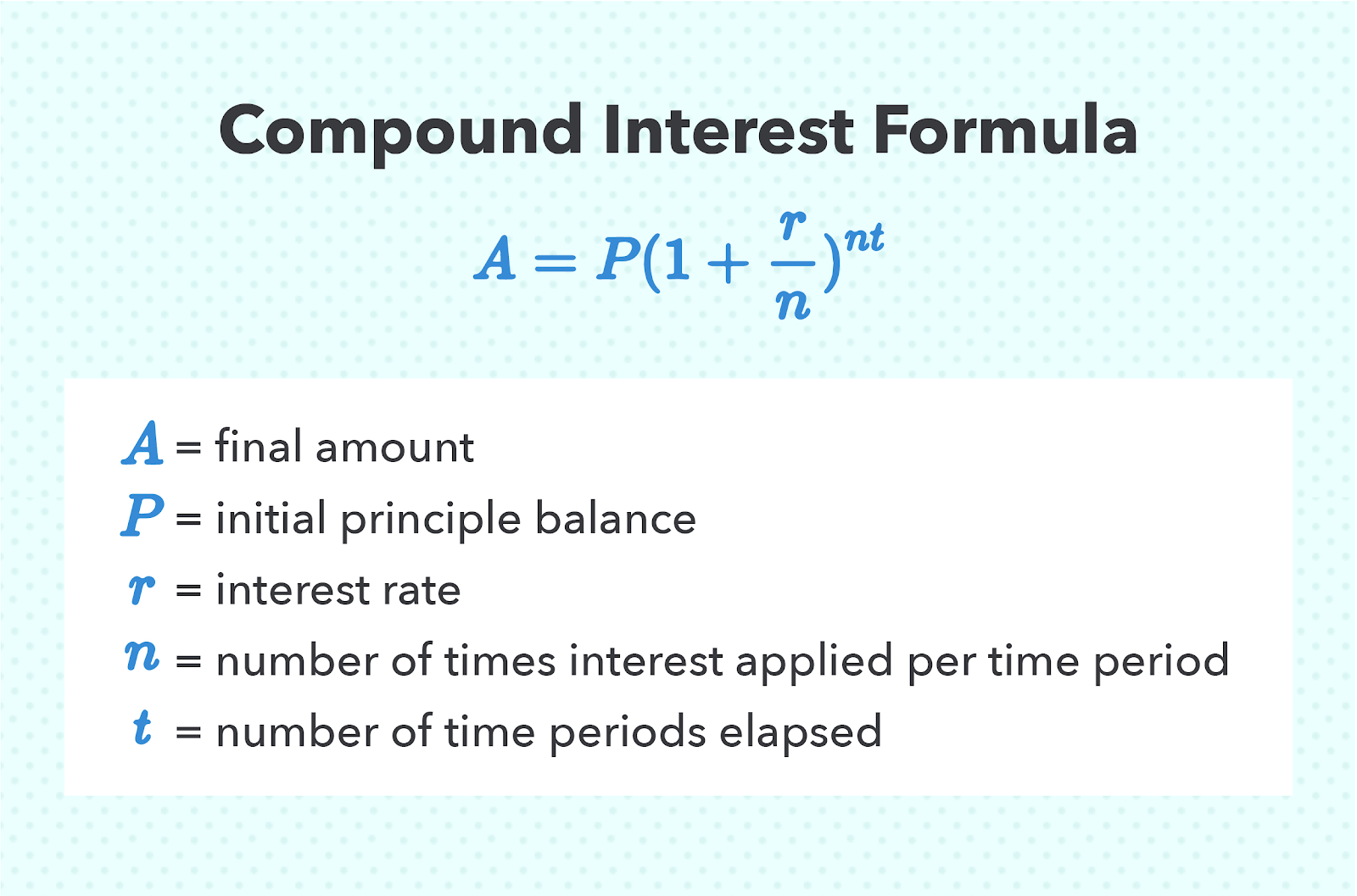

R the compound interest rate. Compound interest is calculated using the compound interest formula.

Compound Interest Calculator

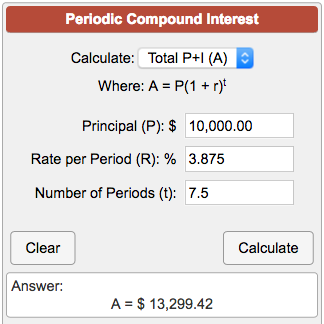

The compound interest formula used in the compound interest calculator is.

. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. Average annual rate of return The formula for calculating average annual interest rate. It will do the rest for you using the above equation.

For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. As a rule of thumb the more frequently compounding occurs the greater the return.

A d 1 r n n p a the amount of money you will have at the end of the deposit period. A P1rnnt A the future value of the investment. The calculator contains options for different compounding frequencies.

Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. Compound interest is the interest imposed on a loan or deposit amount. Here to acquire the rate which is the period rate we use the annual rateperiods or C5C6.

If the annual compound or effective interest rate is 10 with a quarterly interest payment you would receive 241. Annualized Rate 1 ROI over N months 12 N where ROI Return on Investment. Use this interest calculator offline with our all-in-one calculator app.

While calculating daily compound interest again we have to use the same method with the below calculation formula. It is the most commonly used concept in our daily existence. P the principal investment amount.

With it you just need to enter the annual interest rate compounding frequency and initial balance. If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the. Deposits are made at the beginning of each year.

You enter the principal amount. We have to divide the interest rate by 365 to get a daily interest rate. T is the number of years.

R is the annual interest rate. How to calculate compound interest. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually.

Test the Calculator for Daily Monthly and Yearly Compounding Periods. Years at a given interest. If youd like.

The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration. D your initial deposit. R is the annual interest rate.

Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons. Following the aforementioned example the numbers would be as follows. Even small deposits to a.

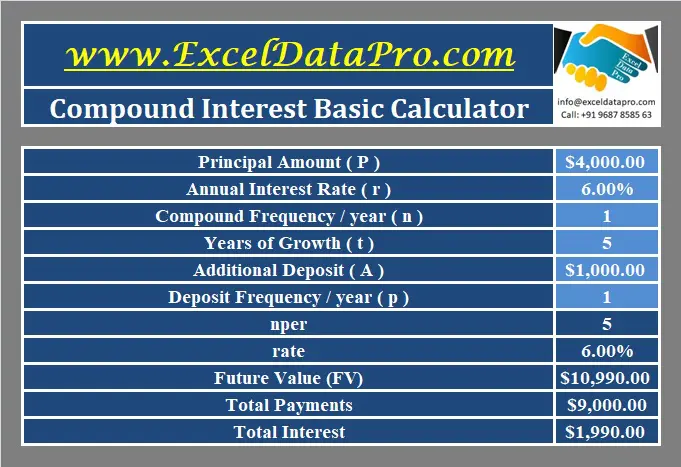

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. The annual rates are usually not as. Compound interest finds its usage in most of the transactions in the banking and finance sectors and other areas.

Principal Interest Rate Compounding. The interest can be compounded annually semiannually quarterly monthly or daily. Our daily compound interest calculator in Excel is working really great.

Subtract the initial balance if you want to know the total interest earned. The reverse calculation would be 102414 1 10 effective annual interest rate. With a crypto daily compound interest calculator to do the math for you you can even make various calculations to compare the results with different interest rates or deposit amounts to.

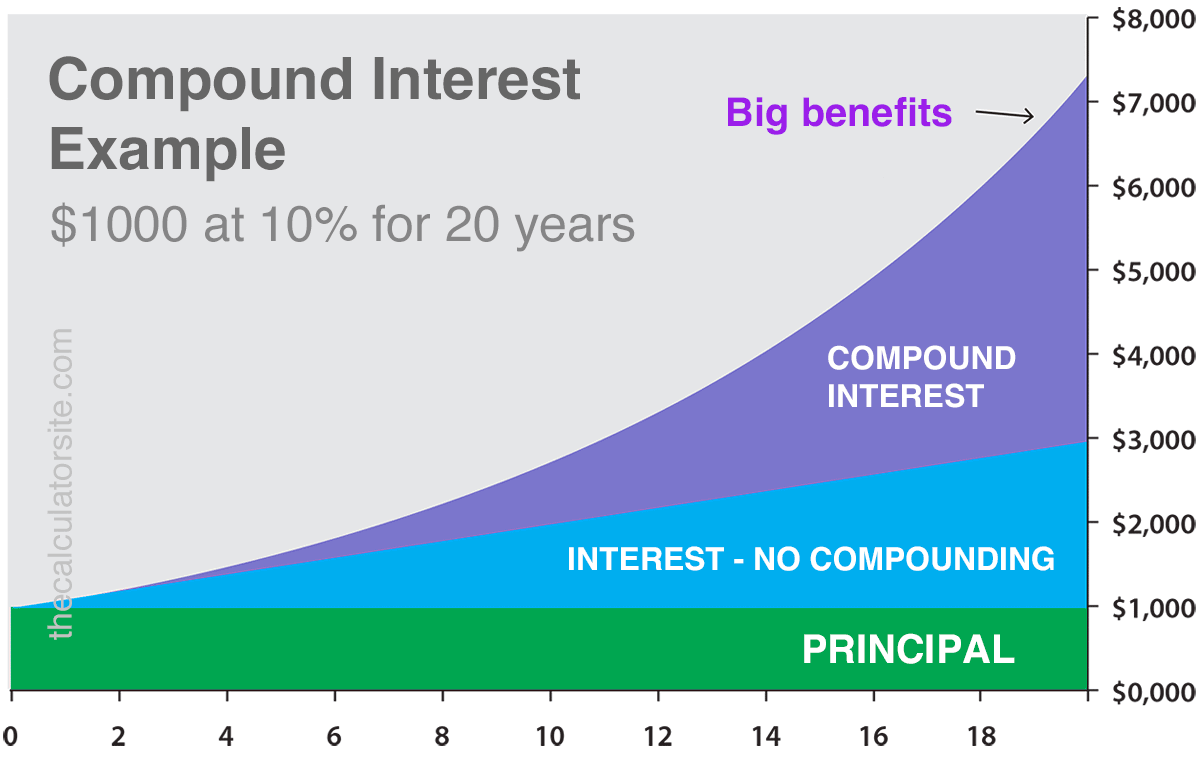

Compound Interest Explanation. You can find many of these calculators online. The detailed explanation of the arguments can be found in the Excel FV function tutorial.

P Principal Amount i interest rate n compounding periods. Or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. Include additions contributions to the initial deposit or investment for a more detailed calculation.

How to calculate compound interest for recurring deposit in Excel. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. The calculation formula is. After a year youve earned 100 in interest bringing your balance up to 2100.

The ClearTax Simple Interest Calculator shows you the simple interest you have earned on any deposits. See how much you can save in 5 10 15 25 etc. To use the simple interest calculator.

Compound interest P 1rn nt - P. Convert Annual Rates into a Daily Monthly or Quarterly. N the number of compounding periods per year eg.

Plus you can also program a daily compound interest calculator Excel formula for offline use. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. You invest 1000 in an account at a bank but this time the bank is promising to pay you an annual interest rate of 4 compounded semiannually for five years.

Formula To Calculate Compound Interest. The formula for compound interest on a single deposit is. The Principle of Compound Interest.

All that happens is that in that three-year period each deposit accrues interest for one more period. N the number of times that interest is compounded per period. For example the amount of 10 compound interest compounded annually will be lower than 5 compound interest compounded semi-annually over the same time period.

To understand the differences between compounding frequencies or to do calculations involving them please use our Compound Interest Calculator. Find out the initial principal amount that is required to be invested. To get the number of.

T the number of periods the money is invested for. So you can use the below formula to calculate daily compound interest. Compound Interest A P 1 i n 1 Where.

P is principal or the original deposit in bank account. To compute compound interest we need to follow the below steps. You earn interest on top of interest.

Understand how compound interest works and take a look at compound interest accounts on offer in Australia. Compound Interest Calculator. R the annual interest rate expressed as a decimal.

You then enter the annual rate of interest. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal.

How to Use the ClearTax Simple Interest Calculator. Principal Amount1Annual Interest Rate365Total Years of Investment365. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued.

You must select the interest type as simple interest. The above calculator compounds interest yearly after each deposit is made.

Capitalize On Uninterrupted Compound Interest Wealth Nation

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

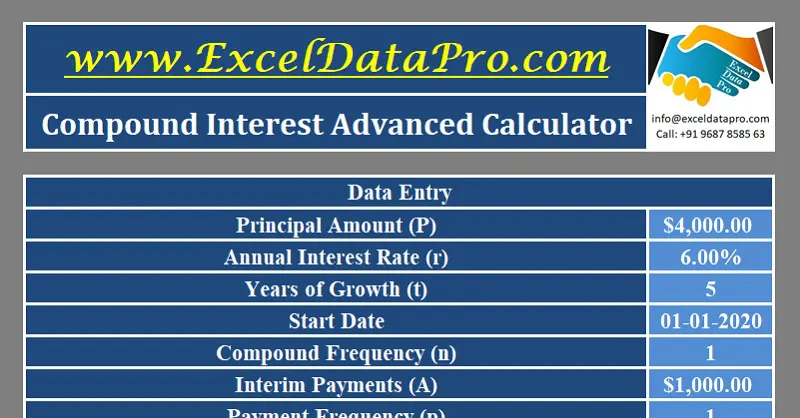

Download Compound Interest Calculator Excel Template Exceldatapro

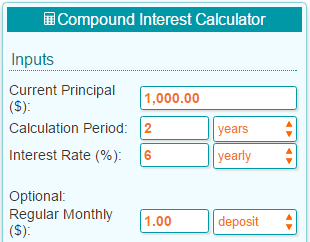

Compound Interest Calculator Daily Monthly Quarterly Annual

Download Compound Interest Calculator Excel Template Exceldatapro

Compound Interest Calculator And Formula Wise

Compound Interest Calculator For Excel

Compound Interest Definition Formula How It S Calculated

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

How Can I Calculate Compounding Interest On A Loan In Excel

Compounding Interest Calculator Yearly Monthly Daily

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Calculator Arrest Your Debt

Compound Interest Calculator With Formula

Compound Interest Formula With Graph And Calculator Link

Compound Interest Calculator Daily Monthly Yearly

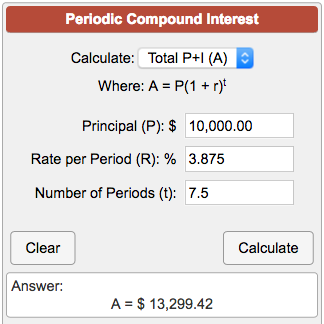

Periodic Compound Interest Calculator